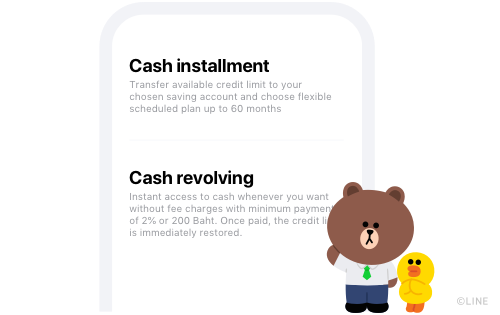

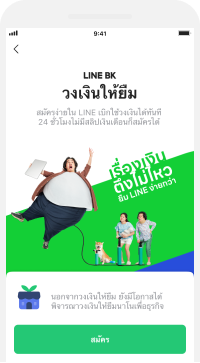

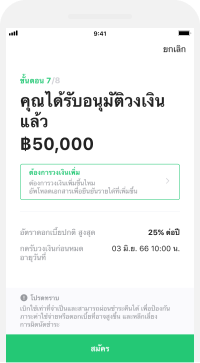

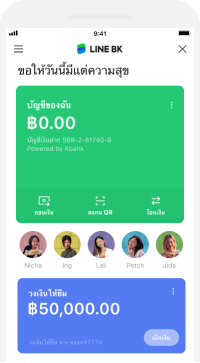

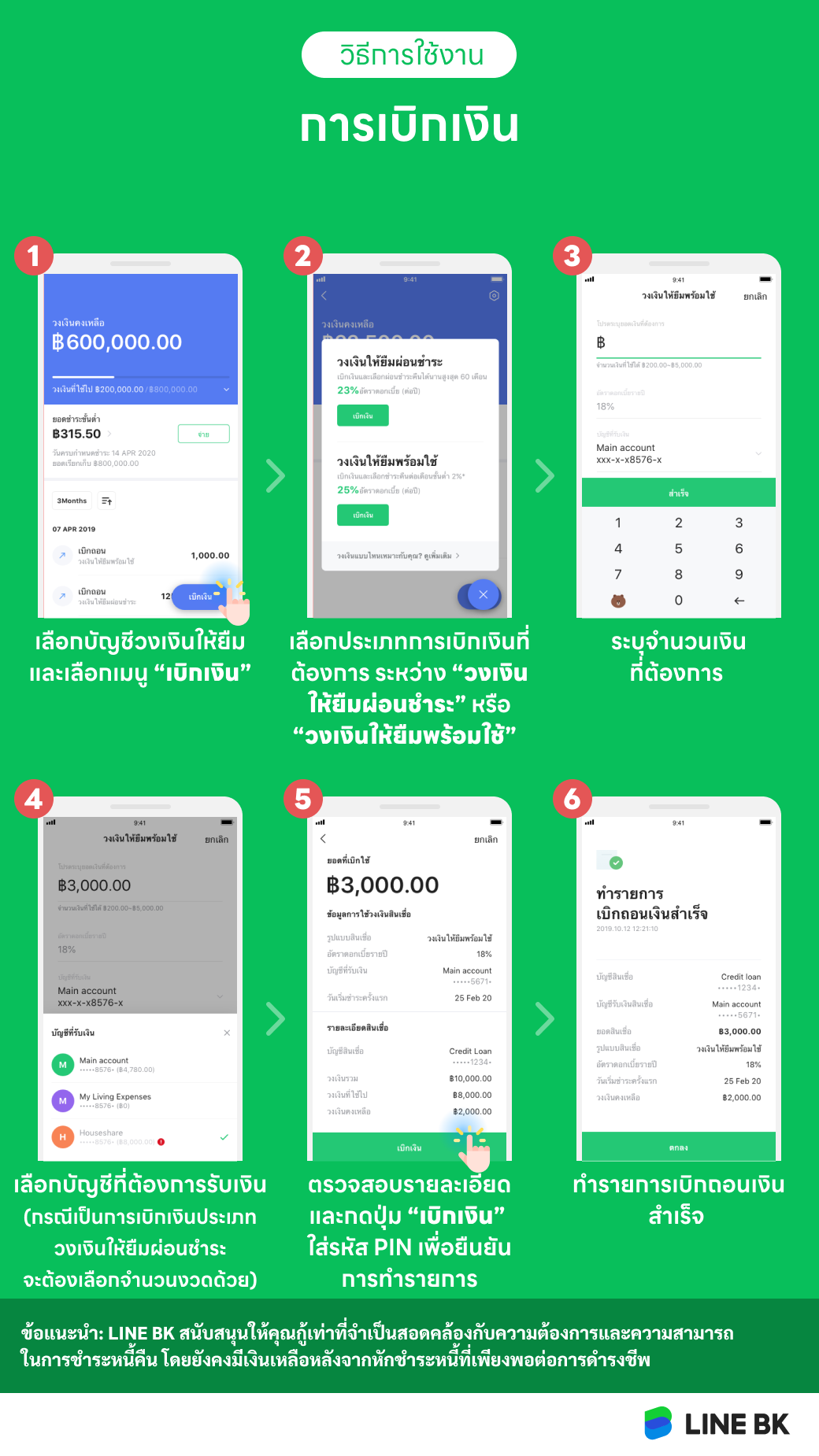

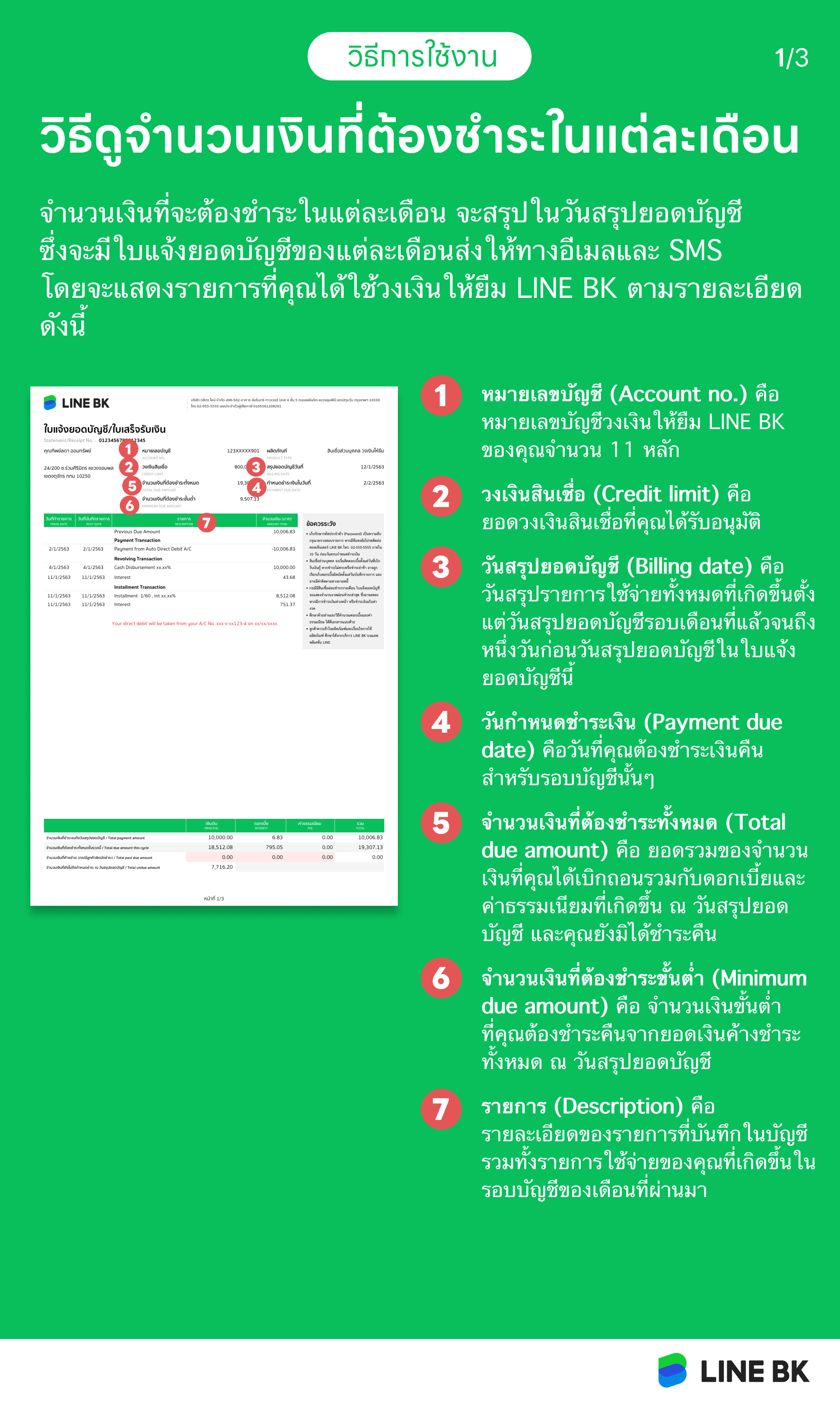

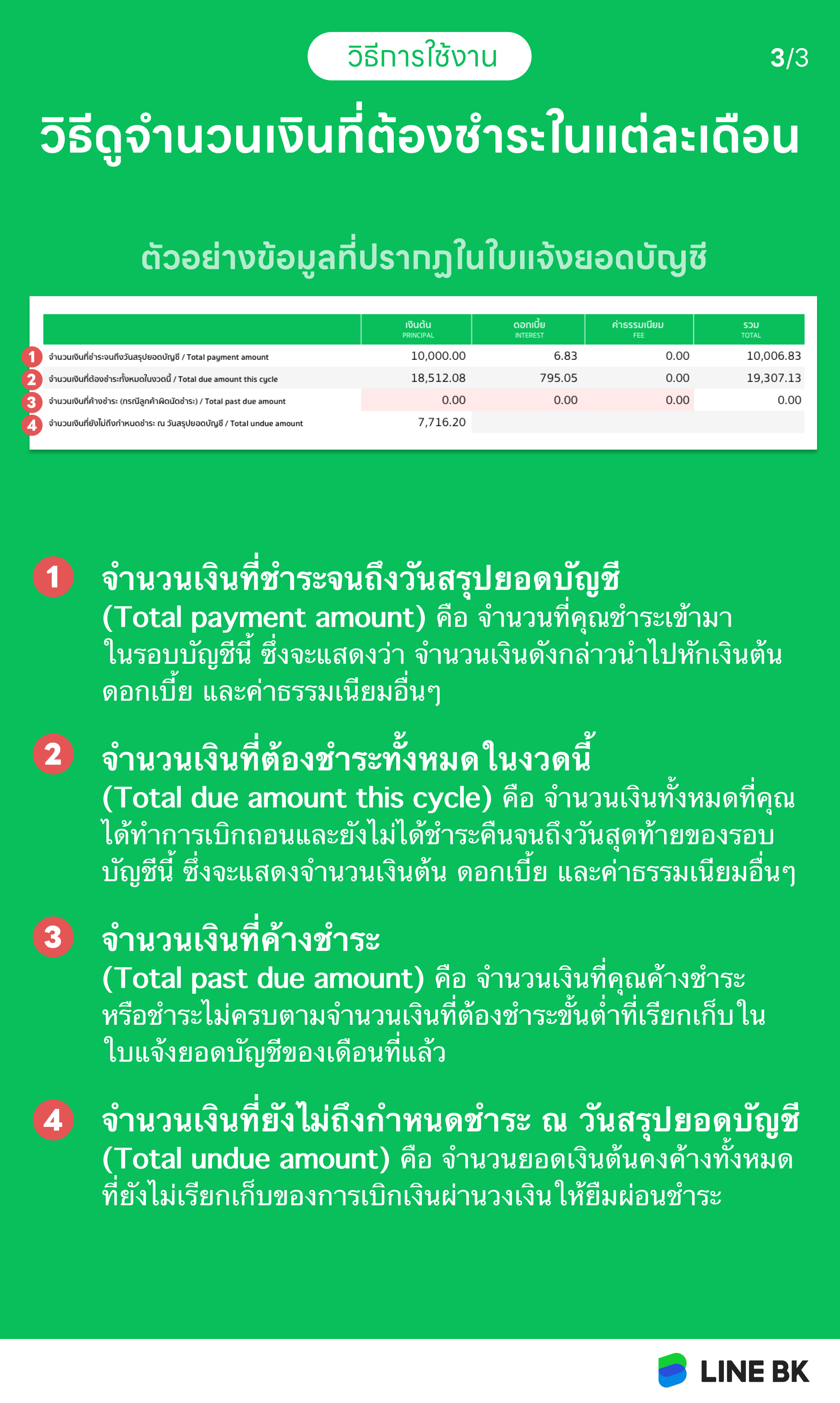

Cash Revolving

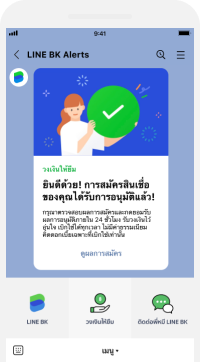

Easy cash withdrawal anytime on your LINE with no fee!

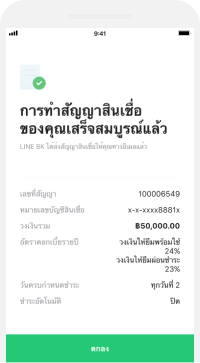

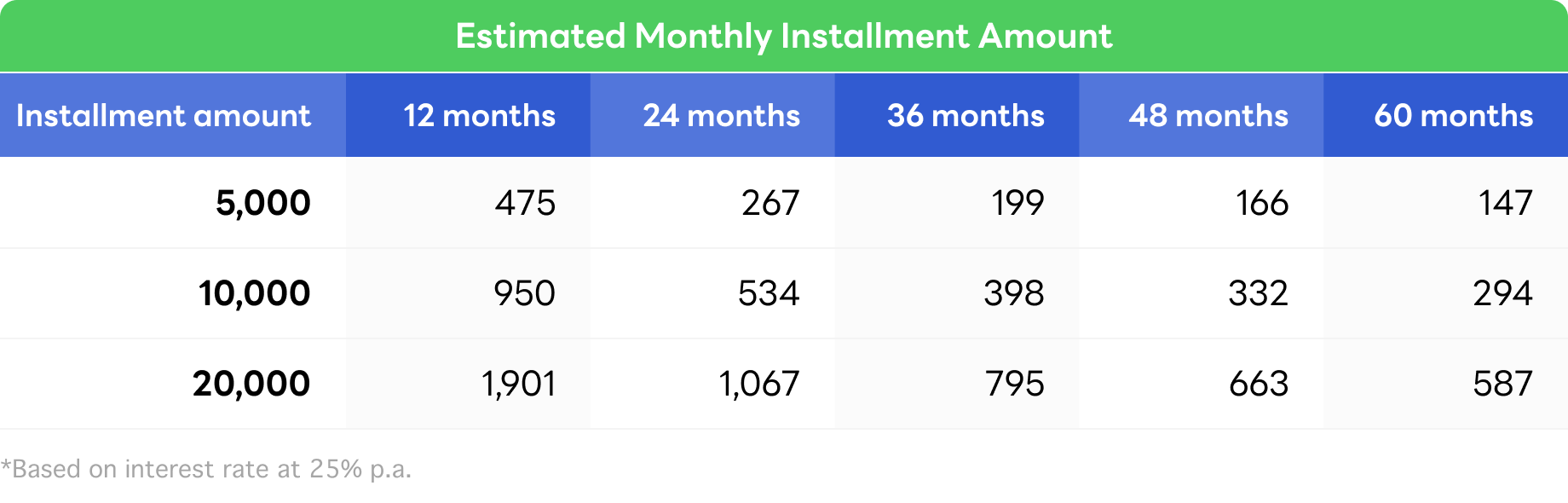

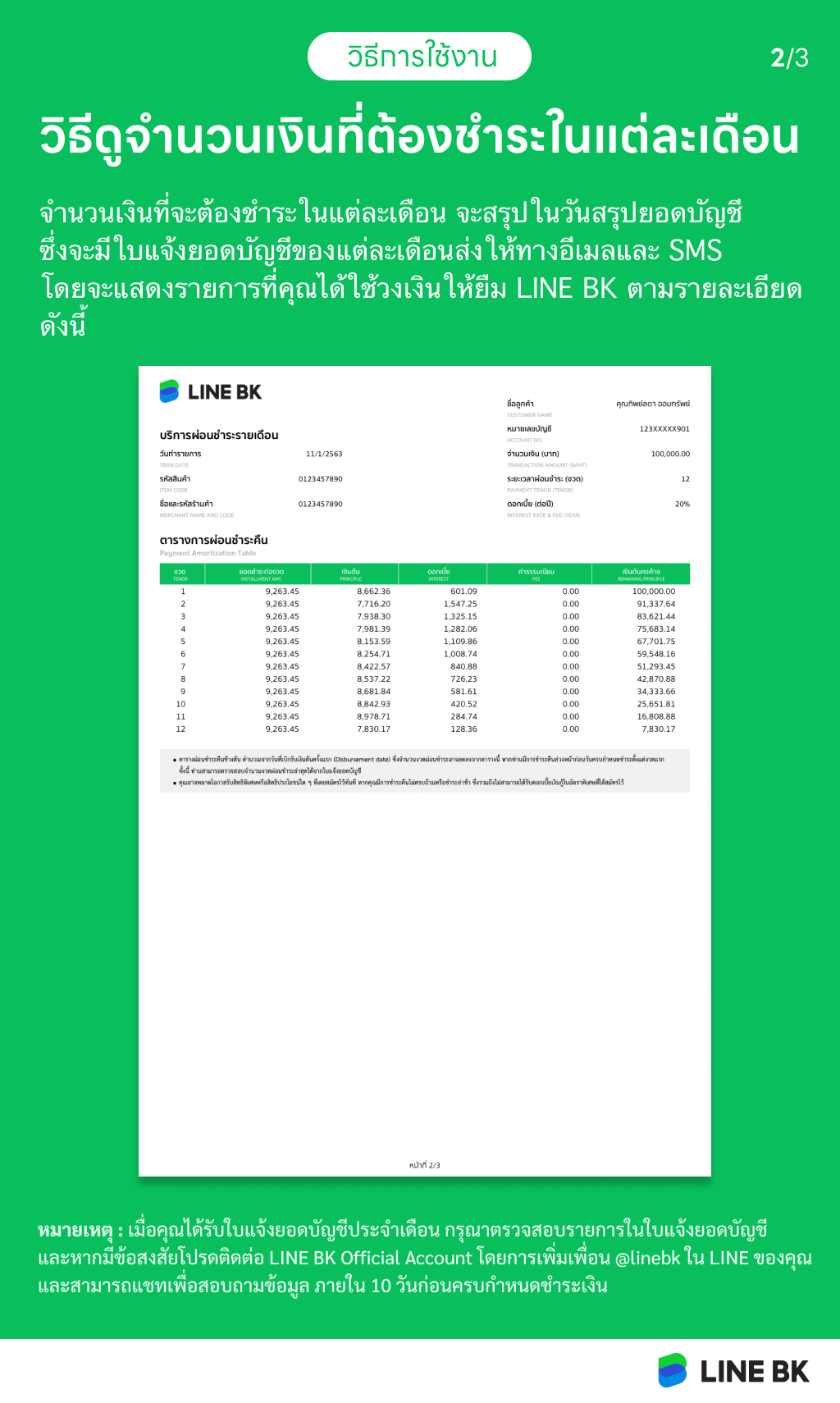

Remark: The assumption calculation is 18% annual interest rate of the minimum 2% disbursement. Your interest/installment may vary from the assumption calculation depending on the amount of the disbursement and the offered interest rate.