On the second anniversary of providing financial services to Thais, LINE BK announces a roaring success, with users exceeding five million, along with a plan to expand in Northeastern

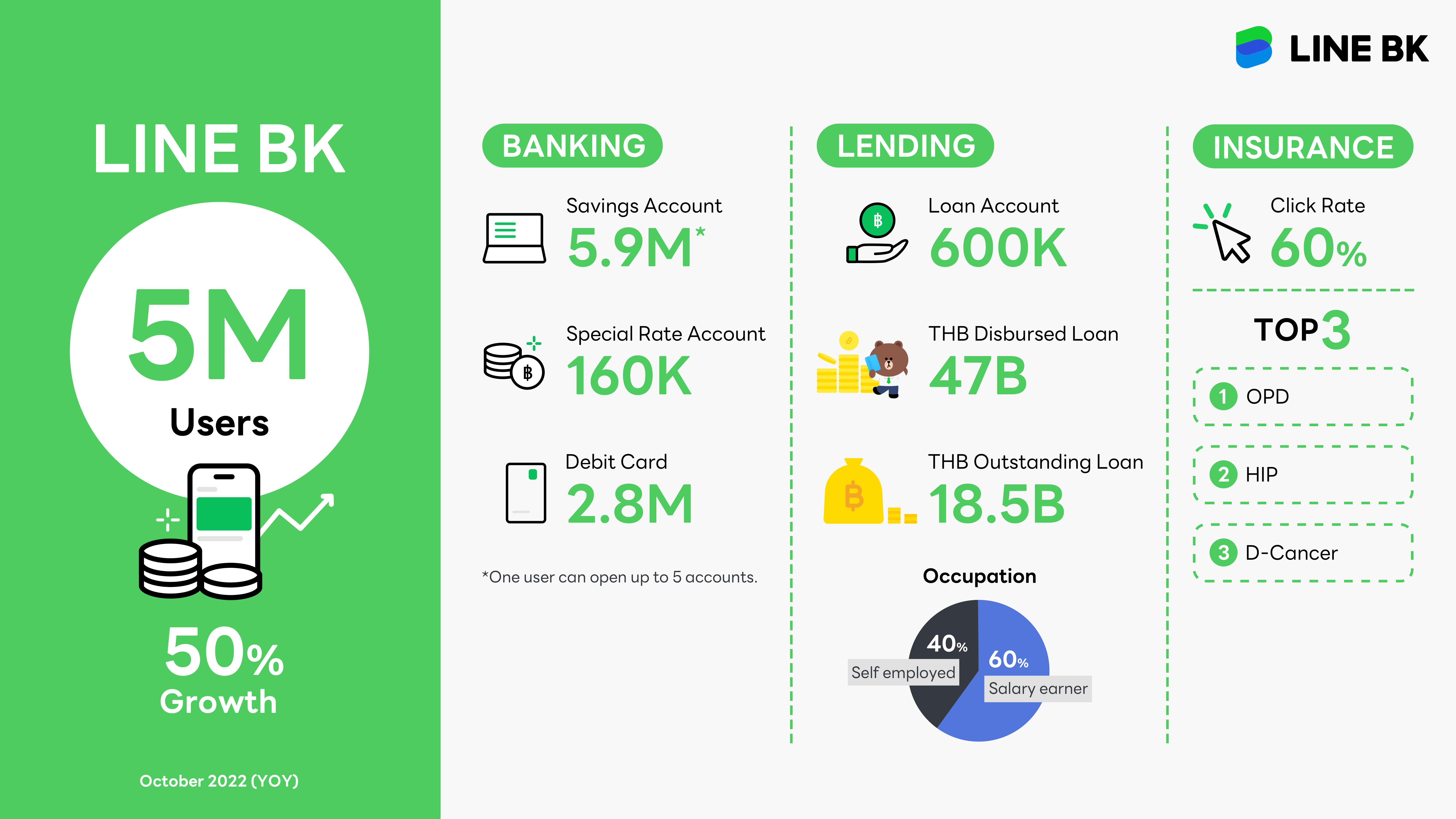

Tana Pothikamjorn, Chief Executive Officer of KASIKORN LINE Co., Ltd., said, during the past two years, LINE BK's operation to bring financial services to customers, integrating into their daily lives via LINE mobile application, has helped Thais learn more about Social Banking and become more conveniently accessible to financial services, underlining the concept "Banking in your hand." Today LINE BK has more than five million users, a 50% year-on-year growth, through its four main services which break down to 5.9 million savings accounts, 160,000 special rate accounts, 2.8 million debit cards and credit line which provides loans to 600,000 accounts.

In terms of LINE BK's financial services during the past two years, LINE BK has launched campaigns to drum up new registrations and constantly developed new features to provide more convenience to customers such as easy sign-up with K+ accounts, resulting in a 20% rise in registration with KBank accounts, and QR payment which allows LINE BK users to scan PromptPay QR codes in LINE application. Moreover, LINE has partnered up with other service providers such as Shopee, LINE MAN, Foodpanda, Lazada and VISA to give more value to its debit card users.

In regard to LINE BK’s Credit Line and Nano Credit line, loan approval for those without fixed income or non-salary earners (freelancers and business owners) stands at 40%. The number of loans provided (disbursed) has accumulated up to 47 billion baht while outstanding loans worth 18.5 billion baht.

LINE BK will continue to target customers who can’t access the traditional loan. As a result of a campaign launched earlier this year from February to April, LINE BK has made new customer bases in all regions of Thailand and sees an opportunity to expand in Northeastern region, following the 52% year-on-year rise of LINE BK loan applications (April 2021) that corresponds to the region’s economic growth in line with the recovery of Thai economy. It’s expected that the demand for business loans and personal loans will also increase accordingly. In this regard, "Ble Pathumrach RSIAM," a Thai country singer renowned amongst Northeastern dwellers, will play a significant role in increasingly communicating to the locals of LINE BK's loan services. More recently, LINE BK has partnered up with Srisawad to offer LINE BK customers who have assets to apply for various types of loans such as auto loans, home and land loans, truck loans and agricultural product loans.

Lastly, in regard to insurance services, LINE BK, through a partnership with Muang Thai Life Assurance, has co-developed a channel to provide life insurance and health insurance via LINE BK. During its launch phase, specific groups of customers will be approached and so far it has been well-received with more than 60% of customers look up for more information after being informed about insurance products via LINE BK’s LINE Official Account. Furthermore, the top three categories that customers look up are OPD (Outpatient Department), followed by HIP (Hospital Income Protection) and D-Cancer (Cancer Insurance).

Regarding LINE BK’s direction and vision in its third year, Tana said more services are in the development pipeline and, through partnerships with other companies, LINE BK will expand its scope of services to provide users with well-rounded services and reach out to existing customers within LINE ecosystem, namely 53 million LINE users, in the following ways.

- Financial services: In the near future, LINE BK will bridge the world of financial services and the world of social media, allowing for transferring of money via chat.

- Credit Line and Nano Credit Line: LINE BK will focus on the overall quality of customers' portfolios among Credit Line and Nano Credit Line products, improve customer selection to effectively reach target customers and use supplementary data to assist the loan approval process. Such process will allow for more convenience in loan applications without requiring customers to submit income documents. So far, LINE BK has developed AI back office to analyze customers and evaluate their risks respectively using behavioral scoring, taking into consideration behavioral and lifestyle factors, to be able to access the right target customers.

- Insurance services: LINE BK prepares to become an insurance broker in 2023 allowing for an easy, convenient and fast insurance purchase. LINE BK will act as an intermediary that selects health insurance products with below-the-market-average premiums to target people with low incomes who want to safeguard their health but can’t afford general health insurance.

LINE BK’s success has been guaranteed with various world-class accolades received in 2022 including:

- The winner of Embedded Finance in the category of Celent Model Bank from Celent Model Awards 2022.

- The winner of Asia’s Best In Customer Interactions from Financial Insights Innovation Awards 2022 (FIIA).

- The winner of Best Digital CX in Banking – Social Channels from Digital CX Award 2022.

- The winner of Most Innovative New User Friendly Social Banking Platform from International Finance Awards 2022.

- The winner of Financial Inclusion Initiative of the Year - Thailand and New Consumer Lending Product of the Year - Thailand from ABF Retail Banking Awards 2022.

- The Winner of Best Digital Collaboration from The Asset Triple A - Digital Award 2022